Introduction

Mexico is the southern neighbor of the USA and one of its most important trade partners. Globalization became a stimulus for the country’s economy. Mexico is a member to several international economic agreements and alliances. It is one of the world leaders in free trade, and a member of NAFTA and other economic formations. International trade plays a key role in the country’s economy. However, the recent world economic crisis and globalization processes present serious threats to the nation.

Overview of Mexico’s economy

Mexico is a developing economy vulnerable to all challenges of the global market and domestic instability factors. At the same time, it has advantages of the geographical position, resources, and workforce. Moreover, it is an attractive export and import partner for the neighbor states, as well as for other overseas countries. The state pursues open trade policy and relies on growth of export and attraction of foreign investment to combat unemployment, get access to the latest technologies, and increase the assortment and affordability of consumer goods (WTO 6). The country’s total Gross Domestic Product (Purchasing Power Parity) was $2.227 trillion in 2015 (CIA). However, the real growth rate in 2015 was only 2.5%, which is the 119th result in the world (CIA).

After his election in 2012, President Enrique Pena Nieto announced a course of actions aimed at economic development. In 2013, Mexico Ministry of the Economy set priorities in the sphere of international trade, namely “(a) to optimize the existing network of trade agreements; (b) to negotiate new agreements; (c) to promote convergence between agreements; (d) to strengthen the multilateral trading system; and (e) to ensure the legal defence of Mexico’s trade interests” (WTO Secretariat 30). The government carried out a range of reforms in education, labor, energy, finance, taxation, and telecommunications in order to ensure stable growth, stimulate the country’s economy, enhance protection from global economic fluctuations, and increase its competitiveness in the global market. Changes in the legislation granted access to private capital to the public auctions in oil, gas, and electricity sectors (WTO 4). In order to maintain multilateral trade, Mexico government followed the recommendations of the World Trade Organization (WTO) and adopted a program of vast tariff cuts for over 20 years, facilitated the procedural part of trade and customs arrangements, and took steps to increase transparency of foreign trade and investment, in particular, timely notification of requirements or subsidies (WTO 6).

International trade alliances, free trade agreements, and recent reforms have increased Mexico’s attractiveness to foreign investors. Thus, the stock of direct foreign investment in the country was $356.9 billion in 2015. However, it was $32.8 billion less than in 2014 (CIA). At the same time, Mexican companies actively expanded their presence in other countries. The stock of direct foreign investment abroad amounted to $142.9 billion in 2015 (CIA).

Despite the increased interest in trade partnership with Mexico, the projected economic growth will remain modest for both internal and external reasons. For instance, the real growth rate in 2015 was only 2.5%, which was the 119th result in the world (CIA). Moreover, the volumes of export and import in 2015 somewhat reduced compared to the results of 2014 (CIA). The external reasons are such global challenges as low prices for oil, declining foreign demand, and increased interest rates. The internal issues hindering economic development are inappropriate legislation, corruption, structural flaws, low productivity, huge informal sector employing half of all workforce, and economic inequality.

Trade agreements and alliances

Mexico is a party to several agreements on trade and economic cooperation; it actively participates in economic forums and is a member of several international organizations and alliances. For example, the country is a member of WTO, Asia-Pacific Economic Cooperation (APEC), the Organization on Economic Co-operation and Development (OECD), the Group of 20 (G20), the United Nations Conference on Trade and Development (UNCTAD), and other forums (WTO 6).

Before the crisis of the 1980s, Mexico maintained domestic economy with a strong protection of national industry and agriculture. International trade and acceptance of investment were selective. However, increased government spending and growing foreign debt led to a deep crisis accompanied by galloping inflation. International Monetary Fund and President Reagan administration agreed to make loans to Mexico under the condition of liberalization of trade (Brown 7-8). The crisis laid the foundation for economic reports and prepared the ground for negotiations on the North-American Free Trade Agreement and further liberalization of the economy.

Free trade agreements (FTAs)

Free trade is the way to boost the country’s economy by attracting investment and removing artificial barriers. Mexico has the largest number of FTAs in Latin America, though the USA remains its major partner. It signed free trade agreements with 46 countries located in Latin and North Americas, Europe, and Asia. Currently, over 90% of trade in goods and services occurs under free trade agreements (CIA). Partial scope agreements covering only exchange of goods exist between Mexico and Brazil, Argentina, Cuba, Paraguay, Uruguay, Venezuela, Panama, Bolivia, and Ecuador (WTO Secretariat 38).

NAFTA

In 1994, Mexico, USA, and Canada formed North-American Free Trade Agreement (NAFTA). It greatly expanded the volume of trade between these countries, in particular, U.S.-Mexico and U.S.-Canada, and stimulated the economy of Mexico. Figure 1 shows the value of NAFTA trade in goods from 1994 to 2012.

Fig. 1. Mexico-NAFTA trade value, 1994-2012 (Barajas et al.)

Trans-Pacific Partnership (TPP)

Searching for new strategic partners and diversification of markets, Mexico entered negotiations on Trans-Pacific Partnership in 2012. TPP stretched its plans beyond usual regulation of tariffs and unification of regulations; its agenda includes measures for financial, economic, and scientific cooperation and covers such areas as digital technologies, regulatory problems, securing opportunities for small and medium business, development and supply chains, and competitiveness (WTO 8).

Pacific Alliance

In June 2012, Mexico formed the Pacific Alliance with Columbia, Peru, and Chile (WTO 8). The aim of the Alliance is to promote free circulation of goods, services, people, and capital.

Mexico’s export

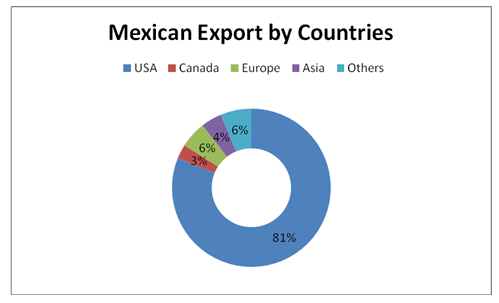

Foreign trade is highly important for Mexico’s economy. In 2015, the country exported goods and services for $381 billon. Therefore, exports account for 17.2% of the GDP. 84% of exports go under NAFTA to the United States and Canada (Workman, “Mexico’s Top 10 Exports”). The USA is the largest export partner of Mexico; the U.S. share in the Mexican export is 81.1% (CIA). 5.4% of Mexico’s goods and services sold externally go to Europe, while only 4.3% go to Asia (Workman, “Mexico’s Top 10 Exports”).

Fig. 2. The structure of Mexico’s export.

Basic export commodities are oil and oil products, manufactured goods, silver, fruits and vegetables, cotton, and coffee. The top ten export commodities provided for 80.1% of the total value of the global shipments (Workman, “Mexico’s Top 10 Exports”). Figure 3 shows ten most important export commodities, their value in US dollars, and their share in the export structure as for 2015.

|

No. |

Commodity |

Value, billion USD |

Share of total exports, % |

|

1 |

Vehicles |

90.4 |

23.7 |

|

2 |

Electronic equipment |

81.2 |

21.3 |

|

3 |

Machines, engines, pumps |

58.9 |

15.5 |

|

4 |

Oil (mainly crude) |

22.8 |

6 |

|

5 |

Medical and technical equipment |

15.2 |

4 |

|

6 |

Furniture, lighting, signs |

9.9 |

2.6 |

|

7 |

Plastics |

8.3 |

2.2 |

|

8 |

Gems, precious metals, coins |

7.1 |

1.9 |

|

9 |

Iron and steel products |

5.7 |

1.5 |

|

10 |

Vegetables |

5.6 |

1.5 |

Fig. 3. Mexico’s export structure by commodity.

The analysis of the data shows a strong competitive advantage in the vehicles market that grew by 54.7% compared with 2011. Another drastic increase by 81.2% occurred in the export of lighting, signs, and furniture. The export of agricultural produce, such as fruits, vegetables, milk and dairy products, cereals, and nuts, as well as beverages, also became more significant. At the same time, foreign sales of gems, cons, and precious metals dropped by 52%, though this category retains its importance (Workman, “Mexico’s Top 10 Exports”).

Mexico’s import

The share of import in the country’s economy was $395.6 billion in 215 (CIA). Its key partners are the USA that enjoys 47.3% of Mexican import, which is almost half of the country’s needs in external goods, and China and Japan, where Mexico imports 17.7% and 4.4% of its goods respectively (CIA). Figure 4 demonstrates the origins of Mexico imports.

Fig. 4. Mexico imports by regions (Workman, “Mexico’s Top 10 Imports”)

The country imports mainly equipment and machines, such as automobile parts, aircrafts and their parts, agricultural machinery, metalworking machines, steel mill products, and electrical equipment. Figure 5 shows the main import categories, their value, and their percentage in the total import.

|

No. |

Commodity |

Value, billion USD |

Share of total exports, % |

|

1 |

Electronic equipment |

85.4 |

21.6 |

|

2 |

Machines, engines, pumps |

67.7 |

17.1 |

|

3 |

Vehicles |

37.3 |

9.4 |

|

4 |

Oil (processed) |

26.5 |

6.7 |

|

5 |

Plastics |

22.3 |

5.6 |

|

6 |

Medical and technical equipment |

15 |

3.8 |

|

7 |

Iron and steel |

9.4 |

2.4 |

|

8 |

Iron and steel products |

9.4 |

2.4 |

|

9 |

Organic chemicals |

8.1 |

2 |

|

10 |

Rubber |

6.6 |

1.7 |

Fig. 5. Mexico’s import structure by commodity.

Over five years, starting from 2010, the import of medical equipment grew up by 34.1%, which shows faster value increase than in any other category. Vehicles and machinery are other gainer categories on the list of imported commodities. At the same time, the share of processed oil and organic chemicals in the structure of import reduced by 24.5% and 15.8% respectively (Workman, “Mexico’s Top 10 Imports”).

Trade relations with Europe

While NAFTA signatories have been and remain Mexico’s key partners, trade with the European Union has developed during the recent years. For instance, in the first quarter of 2015, two-way trade between Mexico and the EU amounted to $14.7 billion (Flanders Investment and Trade 3). Europe is the second largest export market for Mexican goods and services. For the EU, Mexico ranks 16th largest export partner and 21st import partner (Flanders Investment and Trade 3). Crude oil accounts for 30% of Mexico’s exports to Europe; other major export products are machinery and transport equipment (22.8%), electronic equipment (10%), and agricultural produce including beverages and foodstuffs (5%). Key categories of imported products are industrial machinery (23%), electric equipment (14%), vehicles (10%), and processed oil (7%) (Flanders Investment and Trade 3).

Trade relations with the USA

The USA is Mexico’s largest partner in the international trade. It is the third largest importer to the American market and the second largest consumer of American goods (U.S. Department of State). The export-import relations made a turnover of over $590 billion in 2014 (CIA). While Mexico is vulnerable to the fluctuations of the global economy, its economic situation is especially closely linked to that of the USA since the United States is the largest Mexico’s trade partner. For example, Mexico suffered losses in the global economic crisis of 2008. However, as the U.S. economy had recovered by 2014, it positively influenced Mexican vehicles and textile production, which immediately expanded by 3.7% and 2.2% respectively (Flanders Investment and Trade 1). Nevertheless, a possible slow-down of the American economy is ranked first among the external risk factors for Mexico (WTO 4).

Creation of NAFTA in 1994 facilitated and stimulated goods exchange between the USA and Mexico. Though Mexico maintains export-import relations with Canada and the whole USA, three borderline American states (Texas, Arizona, and California) dominate trade with Mexico. A similar tendency is observed on the Mexican side of the border where the northeastern states (Tamaulipas, Nuevo León, Coahuila and Chihuahua) are the main territories where Texas exports its goods. However, the trade relations reach far beyond the borders, for example Michigan is the third largest exporter to Mexico after Texas and California, while the Federal District and the State of Mexico are the main commercial targets for all states (Barajas et al.).

The development of free trade has advantages, too. For example, trade between the USA and Mexico was found to reduce the environmental burden of Mexico’s agriculture since the country can import American grain crops grown with application of intensive technologies instead of expanding local crop areas (Martinez-Melendez and Bennett 2). In February 2008, the countries abolished tariffs on highly sensitive agricultural products (WTO Secretariat 35).

Mexico recognizes that NAFTA and economic cooperation with the USA boosted the national economy and provided affordable goods for the widest range of Mexican citizens. Moreover, NAFTA contributed to the democratic development of the country, for the oppositional party PRI suffered a great setback in 1993 and could lose the presidential elections of 1994 if NAFTA did not provide certain stability (Castaneda 135). The disappointing effects for Mexico have been slow economic growth, especially in the recent years, unequal distribution of investment, since it is mostly concentrated in large cities and industrial areas, and the country’s position in the lower part of the supply chain (Castaneda 136). For example, Ciudad Juarez and maquiladora locations benefit more from trade with Texas than other areas even in the borderline states (Barajas et al.). Moreover, NAFTA turned Mexico into a manufacturing hub for the USA; currently, this position is challenged by China that rapidly becomes a major U.S. partner and world’s leading manufacturer (Watkins 37). Due to the mass migration of Mexicans, Mexico is a major recipient of remittances from migrants, which amounted to $22 billion in 2012 (U.S. Department of State). Mexican citizens expect from the government diversification of the markets and stronger focus on education, and stimulation of science and technology (Kubli-Garcia 17). Other serious challenges for U.S.-Mexico trade are smuggling and illegal traffic over the border.

Get a Price Quote

Top Mexican companies engaged in international trade

Many Mexican companies take part in the international trade. Some of them are large corporations that maintain their presence across the globe, while others are smaller companies that tailor their production to the world’s demand. According to Forbes 2015 Global 2000 rankings, such national giants as FEMSA, Grupo Mexico, Grupo Modelo, and others are also largest exporters (qtd. in Workman, “Mexico’s Top 10 Exports”). At the same time, Zepol review singles out the following smaller companies that are also active in the international market: Tubos De Acero De Mexico producing casing, tubing, pipes, and bridges, Manufacturera Lee De Mexico producing apparel and accessories, vehicle producer Autotek Mexico, and Sitwell S A DE that manufactures seats and chairs (Workman, “Mexico’s Top 10 Exports”). Figure 6 presents the leading Mexican exporters.

|

No. |

Company |

Export commodities |

|

1 |

FEMSA |

Alcoholic beverages |

|

2 |

Grupo Mexico |

Metals, mining |

|

3 |

Grupo Modelo |

Brewery |

|

4 |

CEMEX |

Construction materials |

|

5 |

ALFA |

Food, petrochemicals, and car parts |

|

6 |

Grupo Bimbo |

Bakery |

|

7 |

Arca Continental |

Soft drinks |

|

8 |

Industrial Penoles |

Gold, silver, led, and zink |

Fig. 6. Mexico’s leading exporters.

FEMSA

FEMSA (Formento Economico Mexicano SAB de CV) with headquarters in Monterrey, Mexico, produces, markets, and distributes beverages. With its capital of $33.6 billion, the company is ranked 390th on the Forbes Global list of companies. The company is a licensed producer of Coca-Cola trademark, including Coca-Cola, Pepsi, and other sparkling flavored beverages. Moreover, it produces and trades in still beverages, from milk, tea, and coffee to isotonic drinks. The company distributed goods through OXXO small-format shops in Mexico, as well as other shops. Outside Mexico, it is present in Central America, Argentina, Brazil, Colombia, Costa Rica, Guatemala, Nicaragua, Panama, Venezuela, and the Philippines (Forbes).

Grupo Mexico

Grupo Mexico occupies the 612th position in the Forbes ranking and has a capital of $18.5 billion. The company operates in diversified metals and mining industry. The company’s activities include “metallurgic mining, exploration, exploitation, and benefit of metallic and non-metallic ores, multimodal freight railroad service and infrastructure development” (Forbes). Grupo Mexico has a broad network of branches and subsidiaries. For example, its U.S. subsidiary ASARCO (American Smelting and Refining Company LLC) is the third largest copper producer in the world. Grupo Mexico extracts and refines copper, molybdenum, silver, and other metals. The company also engages in communications and has a nation-wide system of railways in Mexico. It operates mainly in the United States and Peru (Forbes).

CEMEX

CEMEX, which was ranked 908th on the Forbes world’s biggest companies list, has a capital of $10.2 billion. Founded in 1906, CEMEX is one of the oldest Mexican companies. The company is a leader in the Mexican construction industry. CEMEX produces, distributes, markets, and sells cement, ready-mixed concrete, and a variety of construction materials including roof tiles, blended cement, recycled concrete, concrete block, clinker, gravel, sand, and asphalt. It also renders services in construction financing, technical support, mobile solutions, education, and training (Forbes).

Fig. 7. CEMEX sales by region (CEMEX).

The headquarters of the company is located in San Pedro Garza Garcia, Mexico, but it has branches in more than 50 foreign countries and enjoys trade relations with over 108 nations throughout the world. The USA is the largest trade partner of the company, while it is the largest supplier of cement and ready-mixed concrete for the States. CEMEX operates 13 cement plants, 381 ready-mix plants, 77 aggregates quarries, and 42 cement terminals on the territory of the USA (CEMEX).

Conclusion

It is difficult to overappreciate the role of international trade for Mexico. Due to the economic reforms and participation in a number of international alliances and agreements, Mexico has doubled its economic results over the past 20 years. Moreover, the country increased stability, and its citizens got access to a wider diversity of consumer goods for affordable prices. Mexico’s participation in NAFTA gave a stimulus to manufacturing and helped to attract investment to the country. Currently, many Mexican companies, such as CEMEX, Grupo Mexico, or FEMSA, are active players in the world market. At the same time, the country’s role in export-import relationship remains largely confined to processing or assemblage of imported parts with the aim of exporting them further on. Moreover, the economic growth has recently slowed down because of the world crisis. USA is the key partner for Mexico, and the country’s economy largely depends upon the American supply and demand. At the same time, Mexico develops trade relations with the European Union, Asian, and Latin American countries. Globalization presented new challenges to the nation since with the rise of China, it can lose its status of the U.S. major economic partner and manufacturer. To rise to the next level in international relations, Mexico has to solve its internal structural problems, invest into education, science, and technology, combat corruption and illegal market, and diversify its markets.