Abstract

There are various parameters that influence the profitability of a bank. Among them are the environment of operation, the legal and political climate, fluctuations in the financial costs and how individuals speculate changes in the market. This report provides a deep analysis of the effects that foreign exchange rates exhibits in the operations of a bank. Given the global nature of the banking industry, the effects of foreign exchange can only be fully understood and emphasized by looking at the data and examining the financial information that drives and influences the global industry. The level of effect might vary depending upon the transactions carried out by a bank and the level of relationship with the foreign exchange showcase. In this case, local banks are less affected by the global exchanges as compared to multinational banks. Regardless of the way that this examination has shown how much the different business rates impact the efficiency of banks, accomplices in sparing cash establishments can achieve something in guarding a bank’s execution. These players can make and use the systems that will offer security to a bank efficiency from being introduced to sensitive effects of foreign exchange. Their suggestions will go far in guaranteeing that unfavorable impacts of different transformation scale changes are checked. The review goes ahead to empower and offer more fields for experts to recognize how diverse segments influence the development of foreign exchange rates. Such issues bring out the effects of commitments of a country, the cost of a producer and capital aggregate change in the eyes of the public. Preliminary reports have exhibited that these parts can additionally impact the execution of a nation’s economy and, at last, interfere with the banks’ benefits. A standout amongst the necessary changes to have ever happened on the planet in relation to money is the budgetary globalization. The issue has opened the broad trade showcases over the world as country’s exchange with each other, inciting to extending the overall wander. Various nations have taken positions as being either high net banks or large net borrowers. In any case, there are the risks that players need to battle with. There are dangers of such a presentation, elucidation and working presentation, which emits an impression of being a bit of the swapping scale. In broad terms, the transformation level threats can be described as the standard of association execution that will be affected by swapping scale advancement.

Findings and Discussion

Findings

Data

The quarterly information for all unit banks that filled Call Reports for the time of 2011-2015 was gathered. The information for the individual unit banks was at that point was accumulated in view of the most elevated bank holding organization code. An example of ten biggest banks was chosen in the final quarter of 2015 and those ten banks were followed back to 2011 through each quarter to include an adjusted board dataset. Of the ten banks, it was resolved that four ceaselessly gave Call Reports to the Federal Reserve for the whole time frame examined in this time frame. The monetary proportions broke down were then computed for the last specimen of four banks. Furthermore, information relating to the estimation of the U.S. dollar versus pound of different monetary forms was gotten from the Federal Reserve Bank.

To properly interpret and discuss the data, it is inherent to determine how the data was collected and presented. The section below provides the data collection

Collation and presentation of Data

The data was organized into tables as presented in table 1 below.

|

Consolidated Profits (US $m) |

||||||

|

No. |

Bank |

2015 |

2014 |

2013 |

2012 |

2011 |

|

1 |

HSBC Bank |

1,147 |

11,027 |

14,053 |

21,868 |

20,664 |

|

2 |

Citi Bank Group PLC |

11,114 |

3,227 |

11,422 |

11,331 |

7,938 |

|

3 |

Wells Fargo Group |

19,673 |

25,189 |

17,614 |

14,303 |

13,302 |

|

4 |

Barclays Bank PLC |

623 |

845 |

1,297 |

181 |

3,868 |

|

5 |

JPMorgan Chase Bank |

24,442 |

21,745 |

17,886 |

21,259 |

18,956 |

|

6 |

Morgan Stanley Bank |

6,127 |

3,467 |

3,917 |

3,882 |

3,917 |

|

7 |

Goldman Sachs Bank |

6,108 |

8,258 |

7,709 |

6,821 |

6,149 |

|

8 |

Charles Schwab Bank |

1,447 |

1,321 |

1,071 |

928 |

847 |

|

9 |

RBC Royal Bank |

10,026 |

9,004 |

8,342 |

7,342 |

7,347 |

|

10 |

Standard Chartered Bank |

(4,490) |

1,522 |

1,895 |

2,203 |

1,927 |

Source: Specific bank’s investor relations section.

Table 1 showing the banks’ profits for the years 2011 to 2015

Data for the movements in the EUR/USD is as presented in the table below.

|

Year |

EUR/USD |

|

2011 |

1.392705 |

|

2012 |

1.285697 |

|

2013 |

1.328464 |

|

2014 |

1.329165 |

|

2015 |

1.109729 |

|

2016 |

1.115068 |

Source: (US Foreign Exchange Services, 2016)

Table 2 showing the EUR/USD annual exchange rates

Descriptive Analysis of Data

Using the consolidated profits data, a chart was derived indicated the changes in the profitability per bank. The results of the study are as presented in Figure 1 below.

Figure1 showing consolidated profits per year.

The consolidated profits data was further processed to show the total profits from the industry. The total profits were then analyzed against the EUR/USD rate to derive a regression equation in the form of where y is the total profitability for the year and x the foreign exchange rate. The total annual profits for the year were as tabulated below.

|

Year |

2015 |

2014 |

2013 |

2012 |

2011 |

|

Total Profits |

76,217 |

85,605 |

85,206 |

90,118 |

84,915 |

|

EUR/USD Rate |

1.109729 |

1.329165 |

1.328464 |

1.285697 |

1.392705 |

The total profits and EUR/USD Rate was then used in the derivation of a regression equation and the findings were as presented in the table below.

|

SUMMARY OUTPUT |

|

|

|

|

|

|

|

|

|

|

|

|||||||

|

Regression Statistics |

|

|||||||

|

Multiple R |

0.729531 |

|

||||||

|

R Square |

0.532216 |

|

||||||

|

Adjusted R Square |

0.376288 |

|

||||||

|

Standard Error |

3988.518 |

|

||||||

|

Observations |

5 |

|

||||||

|

|

|

|||||||

|

ANOVA |

|

|||||||

|

|

df |

SS |

MS |

F |

Significance F |

|

||

|

Regression |

1 |

54298332.7 |

54298332.7 |

3.41321331 |

0.1618281 |

|

||

|

Residual |

3 |

47724822.1 |

15908274 |

|

||||

|

Total |

4 |

102023155 |

|

|

|

|

||

|

|

|

|||||||

|

|

Coefficients |

Standard Error |

t Stat |

P-value |

Lower 95% |

Upper 95% |

Lower 95.0% |

Upper 95.0% |

|

Intercept |

40156.60 |

24020.79 |

1.67 |

0.19 |

-36288.27 |

116601.46 |

-36288.27 |

116601.46 |

|

EUR/USD Rate |

34329.23 |

18581.57 |

1.85 |

0.16 |

-24805.61 |

93464.08 |

-24805.61 |

93464.08 |

|

|

|

|||||||

|

|

|

|||||||

|

|

|

|||||||

|

RESIDUAL OUTPUT |

|

|||||||

|

|

|

|||||||

|

Observation |

Predicted Total Profits |

Residuals |

Standard Residuals |

|

||||

|

1 |

87967.1 |

-3052.0952 |

-0.8836004 |

|

||||

|

2 |

84293.59 |

5824.40751 |

1.68620196 |

|

||||

|

3 |

85761.75 |

-555.75088 |

-0.1608933 |

|

||||

|

4 |

85785.82 |

-180.81567 |

-0.0523473 |

|

||||

|

5 |

78252.75 |

-2035.7457 |

-0.589361 |

|

|

|

|

|

Table 3 showing summary output of regression analysis

Using the summary output a linear regression equation in the form of was derived as follows

Discussion

As the globalization procedure has gotten its speed in the previous three decades, expansive U.S. banks, as well as their major corporate customers, continue expanding their global presentation. Therefore, productivity of those extensive banks may be fundamentally influenced by changes in return rates. At first, we attempted three noteworthy money records, U.S. Dollar, Euro, and Asia, to speak to three biggest financial squares in the world. Be that as it may, two records, U.S. Dollar and Euro, are splendidly corresponded with each other over the example time frame. The relationship coefficient is 89%. Relapse comes about additionally cover genuine multicollinearity issues when both files are incorporated into a relapse demonstrate. Hence, just the U.S. Dollar and Asia records are utilized as intermediaries for conversion standard hazard in this study.

Where Earningst is the rate change in net profit for every bank and Asiat, and Dollart are cash lists for Asia and U.S. dollar, individually. ALLL1 is the one quarter-slacked exchange weighted general dollar record against world significant monetary forms accumulated. Bank execution is absolutely influenced by extra firm-particular factors. In this way, we chose three essential factors from the accounting report to control for variety in Earningst brought about by these miniaturized scale factors.

Where:

TETAt is a proportion of Total Equity/Total Assets

FLTA, is the proportion of Foreign Loans/Total Assets FADAt speaks to foreign assets/Domestic Assets. Both Equations (1) and (2) are assessed by the pooled cross-area heteroskedasticity and time-wise autoregressive technique depicted in Greene (2000). This strategy ascertains a board amended covariance lattice of the coefficient gauges and uses board revised standard blunder. Keeping in mind the end goal to distinguish potential multicollinearity issues inserted in the relapse models, we direct a key parts and figure investigation. Results don’t show any solid straight conditions among the free factors in a change deterioration extents network. We evaluate the accompanying model to survey the impact of trade rates on bank execution:

The coefficient of the EUR/USD rate was found to be positive. The positive sign on the coefficient (+34329) indicates that the profitability of the banking sector is positively related to the foreign exchange markets. Consequently, if the USD weakens against the Euro, the profitability of the banking sector in the United States weakens. On the other hand, the profitability of the United States banking sector strengthens if the USD strengthens against the Euro. The positive relationship was further confirmed by the scatter plot below. the scatter plot also shows limited explanatory power of the model and also demonstrates the need for further research in order to make an inference on the how foreign exchange rates affect profitability in the banking sector.

From the chart above, the coefficient of determination was found to be 0.5322. The interpretation of this value indicates that the movements in the EUR/USD rate provide for weak explanations to the profitability in the banking sector (Bryman & Bell, 2015). This indicates that there are other factors that explain the profitability of the banking sector and among these factors there would be the rate of inflation as well as the levels of interest rates in the market. Additionally, the performance of the banking sector would be affected by other factors such as the performance of the capital, property markets, and the commodities markets. It is therefore recommended that further studies be conducted to explore the factors that affect the profitability of the banking sector other than the foreign exchange rates. Further, the studies could use other methodologies of testing the data including granger causality between the various variables. Panel data studies would also be appropriate in meeting the objectives of the study.

Get a Price Quote

Interpretation of Results

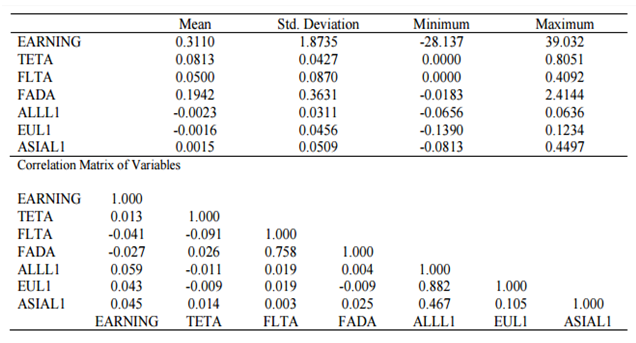

A relation of quarterly change in net pay (EARNING) of biggest U.S. banks with respect to changes in different coin files. It is important to assess how bank income react to changes in estimations of outside monetary standards with respect to the U.S. dollar. A huge relationship may demonstrate that, in the progressively worldwide business environment, U.S. banks are not disconnected from levels of global financial movement. From the main table, it is clear that, in reality, change in U.S. banks’ salary is connected to both dollar list, a record which measures the estimation of U.S. dollar with respect to the wicker container of worldwide coinage, and is likewise altogether identified with the Asian record which is contained a wicker bin of Asian monetary forms and in addition an European record. Table 1 introduces a relationship framework of the factors used in the relapse investigation. From the comes about, there is a high connection between the bushel of European monetary standards (EUL1) and the U.S. dollar (0.882) and a littler connection between the U.S. dollar (ALLL1) and ASIAL1 (0.467). In this way, with a specific end goal to keep away from multicollinearity, EUL1 and ALLL1 won’t be incorporated into an indistinguishable models from autonomous factors. It is intriguing to note that the connection between the ALLL1 and ASIA1 is much higher than the connection amongst ASIAL1 and the EUL1 (0.105).

Descriptive statistics

EARNING= Quarterly rate changes in net profit.

TETA= proportion of aggregate value to aggregate resources.

FLTA= proportion of remote advances to aggregate resources.

FADA= proportion of remote advantages for residential resources.

ALLL1= One quarter-slacked exchange weighted general dollar list against world significant monetary standards

EUL1= One quarter slacked exchange weighted dollar list against significant European monetary standards

ASIAL1= One quarter slacked exchange weighted dollar list against significant Asian monetary standards

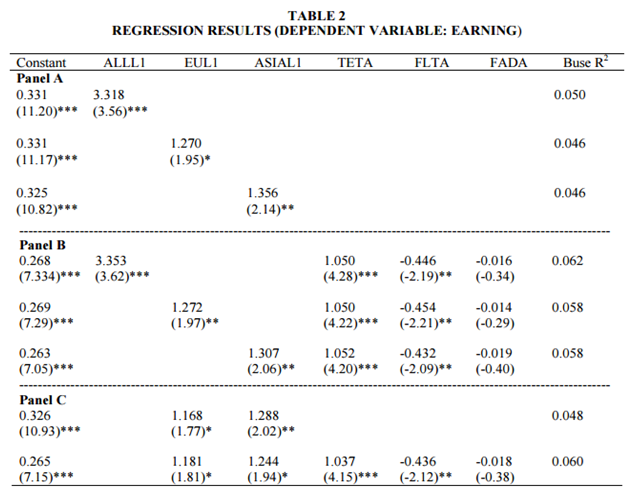

Table 2 presents three boards of relapse results that assess the relationship between money records and quarterly percent change in profit of the biggest U.S. based business banks. The cash lists are slacked one quarter, as the examination goes for measuring the impact of a prior quarter cash change on the present quarter’s bank profit. Board A shows three basic models where the autonomous factors are basically the money lists. From the outcomes, ALLL1 is decidedly identified with percent change in bank profit (3.318, t-statistic=3.56), as are EUL1 and ASIAL1 (1.270, t-statistic=1.95; what’s more, 1.356, t-statistic=2.14, individually). In this way, as the estimation of the U.S. dollar rises relative to the estimation of the wicker bin of worldwide monetary forms, U.S. banks benefit. It is for sure an interesting result, on the off chance that one is to accept that a solid cash is an impression of expanded monetary action. The U.S. doing great in respect to the world enhances benefit era for U.S. based money related foundations. In this manner, we can see that U.S. banks perform better as the dollar ascends in esteem against both European and Asian monetary forms.

***, **, * Represent the 1, 5, and 10% essentialness level, separately. t-insights are in enclosure.

Buse R2 = Buse crude minute R-squared. EARNING= Quarterly rate changes in net income. TETA= proportion of aggregate value to aggregate resources. FLTA= proportion of outside credits to aggregate resources. FADA= proportion of outside resources for household resources.

ALLL1= One quarter-slacked exchange weighted general dollar file against world real monetary forms accumulated.EUL1= One quarter slacked exchange weighted dollar file against real European monetary forms accumulated. ASIAL1= One quarter slacked exchange weighted dollar record against significant Asian monetary standards.

In panel B of Table 2, we incorporate three bank proportions to advance explore the quality of the relationship between coin lists and the percent change in profit of the U.S. banks. The outcomes demonstrate that the consideration of extra factors into the model does not affect the quality or the bearing of the relationship between money records and the benefits of U.S. banks. ALLL1 is decidedly identified with EARNING (3.353, t-statistic=3.62), as are EUL1 and ASIAL1 (1.272, t-statistic=1.97; and 1.307, t-statistic=2.06, individually). Moreover, it is clear that the proportion of value to aggregate resources is emphatically identified with EARNING, for instance TETA is decidedly identified with EARNING in the ALLL1 show (1.050, t-statistic=4.28). In this way, higher capitalization and lower hazard are emphatically identified with bank execution. It is fascinating that outside advances as a rate of aggregate resources (FLTA) are contrarily identified with EARNING in each of the three models of Panel B. For instance in the model relating EUL1 to Winning, the relationship between the two factors is negative (- 0.454, t-statistic=-2.21). The suggestion is straightforward. Each of the three models in Panel B don’t exhibit a noteworthy relationship between outside resources as a percent of local resources. From this, we can extrapolate that remote loaning is a valid wellspring of hazard and maybe outside direct speculation by the U.S. banks is not sufficiently noteworthy to affect bank benefits, particularly when controlling for outside loaning of the biggest U.S. based business banks. Board C of Table 2 exhibits the aftereffects of two extra models. As beforehand said, the connection lattice in Table 1 demonstrated a low relationship amongst EUL1 and ASIAL1. Accordingly, we incorporate both factors in a solitary model. This would serve as a vigor check. The outcomes in Panel C of Table 2 demonstrate that EUL1 and ASIAL1 are decidedly identified with EARNING (1.181, t-statistic=1.81; and 1.244, t-statistic=1.94, individually). Moreover TETA is emphatically identified with EARNING (1.037, t-statistic=4.15) also, FLTA is contrarily identified with EARNING (- 0.436, t-statistic=-2.12). Hence, the outcomes of the models in Panels A and B of Table 2 are upheld by the discoveries in Panel C.

Conclusion and Recommendation

From these outcomes, it is clear, that the estimation of the dollar in respect to a wicker bin of worldwide coinage, a wicker container of European monetary forms and a bushel of Asian coinage, is decidedly identified with the profits produced by the biggest U.S. based banks. The outcomes depend on an adjusted board of the biggest 10 U.S. business banks over a forty-year time span (2011-2015). Furthermore, on the grounds that the records values utilized as a part of the relapse are slacked one quarter, we can infer that the ascent in the estimation of the U.S. dollars versus different wicker container of remote monetary standards will improve the income of U.S. based organizations later on quarter. From the late money related emergencies, the world has discovered that an expanded comprehension of the dangers connected with bank benefits, as well as consistency of bank benefits can upgrade the capacity of controllers, bank administrators and shareholders to alleviate any future monetary defeats. The discoveries of this paper fill that need.